Ensuring compliance

Rely on us for compliance with industry standards and applicable laws.

Ensuring compliance and controlled operations.

Being the leading pan-European provider of payment and transactional services, our clients need to be able to rely on us at all times. That's why we ensure compliance with all applicable laws, industry standards, rules and regulations. In addition, we focus on operational excellence and ensure controlled operations. Since we are considered a critical infrastructure, we are supervised by both European and national oversight authorities.

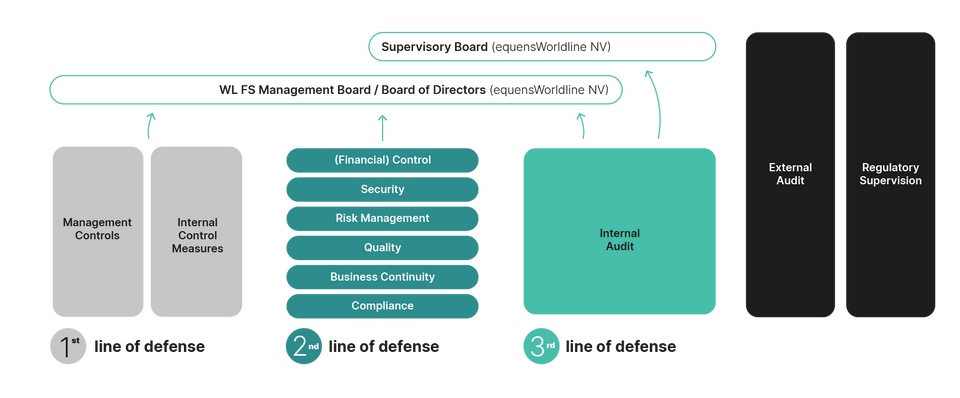

To ensure controlled operations, we operate according to the 'Three lines of defense' model.

Three lines of defense

-

The first line of defense is responsible for implementing, monitoring and reporting on risk, compliance, internal controls, security and business continuity

-

The second line of defense supports the Business and provides management assurance. Key activities are the developing the policies, monitor and report about the implementation and raise awareness on these topics.

-

The third line of defense provides independent assurance on the effectiveness of the first and second line of defense.

Internal audit

The Group Internal Audit has been setup within Worldline to provide independent assurance by examining, evaluating and reporting on the adequacy and effectiveness of the Company’s system of internal control. The company’s adopted a 3 lines of Defense model as well as a system of internal control designed to provide assurance that:

- applicable laws and regulations are complied with;

- instructions and (corporate) guidelines approved by eW management are applied;

- the company’s internal processes are functioning correctly; and

- financial and management information is reliable.

As part of Worldline, the Managing Board of Worldline Financial Services has a responsibility to its stakeholders to increase the value of the business while safeguarding the assets, and ensuring the integrity and continuity of services provided to our clients and compliance with applicable laws and regulations.

The Group Internal Audit Financial Services as an integral component of the Worldline internal control system, provides audit. It is providing audit assurance to the Managing Board of Worldline Financial Services of the effectiveness of internal control processes and recommendations for improvements of internal improvements processes. Based on a formalised (internal) agreement the Group Internal Audit Financial Services also provides (similar) audit assurance services to the Board of Directors of equensWorldline NL.

Hierarchically, the Head of Internal Audit (Audit Director) of the Group Internal Audit Financial Services reports directly to Worldline’s Chief Audit Executive (CAE).

Mandates, responsibilities and core processes are described in the Worldline Internal Audit charter as approved by the Worldline CEO, endorsed by Worldline Audit Committee.

Complying with all relevant industry standards.

As a leading payment services provider, we comply with all applicable rules and regulations in the industry, e.g. from the card schemes (e.g. MasterCard, Visa) and from the European Payments Council (EPC) that publishes the SEPA Rulebooks for payments. The smooth processing of transactions depends on correctly and timely updating the systems accordingly. We ensure this at all times, thus complying with these industry requirements.

-

SEPA Credit Transfer and SEPA Direct Debit are described in the SEPA Rulebooks developed and published by the European Payment Council (EPC). These EPC Rulebooks need to be implemented accordingly.

-

The EPC developed a SEPA Instant Payments Rulebook, that is the basis for all European Instant Payment schemes.

-

Card schemes distribute bulletins and release notes which have to be checked on applicability and implemented accordingly.

Complying with applicable laws and monitoring changing regulations.

Complying with applicable laws is important. Our Compliance Division monitors and reports on the compliance with applicable laws. On top of existing laws and regulations, we have a legal monitoring process in place, scanning for upcoming laws and changing regulations in order to identify changes and implement these accordingly.

-

The Regulation (EU) 2016/679 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data (General Data Protection Regulation – “GDPR”) is directly applicable in all EU Member States, harmonizing the data protection regulations throughout the EU and setting out one of the highest data protection standards in the world. We respect every individual’s privacy rights and guarantee our compliance with the GDPR as well as other applicable data protection laws. Appropriate measures are implemented to secure a safe and lawful processing of personal data.

-

The Dutch Act on Financial Supervision (Wft) regulates the supervision of financial institutions in the Netherlands. As of 1 January 2014 ‘afwikkelondernemingen’ became in scope of the Financial Supervision Act and as from that date the Act became applicable for equensWorldline. All regulated activities are managed by our subsidiary equensWorldline NV. Both equensWorldline SE and equensWorldline NV are operating under the registered tradename Worldline Financial Services.

-

This Modern slavery statement has been published in accordance with the Modern Slavery Act 2015. It sets out the steps that we have taken to ensure that slavery and human trafficking are not taking place in its supply chains and in any parts of its business.

Download

Worldline modern slavery statement (PDF) -

In accordance with the Worldline’s Code of Ethics, its Business Partner’s commitment to integrity and the principle 10 of the United Nations Global Compact, the company is committed to conduct its business fairly, honestly and lawfully with whomever and wherever doing business, to work against Corruption in all its forms, including bribery, solicitation and extortion.

Download

Worldline Anti-corruption statement (PDF)

Supervised by national and European oversight authorities.

Based on our role as critical infrastructure, we are is supervised by national and European oversight authorities.

In the Netherlands equensWorldline, operating under the registered trade name Worldline Financial Services, has a license as settlement institution. Our subsidiary equensWorldline NV is supervised by both the Dutch National Bank (DNB) and the Dutch Authority for the Financial Markets (AFM) in accordance with the Act on Financial Supervision (Wft).

In Belgium equensWorldline is under oversight by the National Bank of Belgium (NBB) in its context as systemically relevant payment processor. The oversight is done in accordance with the Act on Processors.

Our CSM is also under oversight by the Eurosystem, which comprises the European Central Bank and the national central banks of the Member States whose currency is the euro. The supervision is performed by the Dutch National Bank on behalf of the Eurosystem.

-

The Eurosystem promotes the safety and efficiency of payment, clearing and settlement systems under its oversight mandate. Our CSM is under oversight by the Eurosystem. The Principles for Financial Market Infrastructures (PFMI) are the basis for the oversight framework.

-

DNB focuses on promoting the solidity of financial undertakings and contributing to the stability of the financial sector (prudential supervision).

The Dutch Act on Financial Supervision (Wft) regulates the supervision of financial institutions in the Netherlands. As of the 1st of January 2014 settlement institutions became in scope of the Financial Supervision Act and as from that day the Act became applicable. The supervision is executed by both Dutch National Bank (DNB) and Authority Financial Markets (AFM).

-

Authority Financial Markets (AFM) focuses on orderly and transparent financial market processes, proper relationships between market participants and care in dealing with clients (market conduct supervision).

-

The proper functioning of card payment processing in Belgium, given its role in the real economy, is a primary objective of the Bank’s oversight. As of the law of 24 March 2017 on the oversight of payment transaction processors, equensWorldline as systemically relevant payment processor, is under the direct legal oversight of the National Bank of Belgium.

-

A memorandum of Understanding (MoU) between De Nederlandsche Bank (DNB) and Banca d’Italia (BdI) was formalized. Financial Supervision Act, article 2:3.0d(1) License to carry on the business of a settlement institution established in the Netherlands.

Certifications

In the payments industry, being compliant and certified is a critical factor. Worldline regards security, business continuity and quality as crucial. Therefore we have obtained the applicable ISO 9001:2015, ISO 27001:2013, ISO 22301:2019, ISAE 3402 and ISAE 3000, PCI and other industry certifications in many countries in which we operate.

Any questions? We are here to help

If you have any questions about compliance please click on the button below and send us a message.

-

-

-

The Future of Authentication: Exploring the impacts of FIDO

Learn more -

Empowering Self-Service: LM Control and Worldline's Transformative Payment Solutions

-

What’s the future of fraud prevention?

-

-

-

Worldline announces partnership with risk expert RiskQuest BV to provide best-in-class credit checking

Learn more -

Mastering the Art of Delivering Payments Acceptance Excellence: Choice of Payment Methods and New Ways to Pay