In our previous blog article, we quoted the IPCC (Intergovernmental Panel on Climate Change) with the stark reminder that "Environmental change is widespread, rapid and intensifying". The IPCC reaffirmed this message in their last publication from March 2022 while emphasising the fact that the time for action is now.

This means it is no longer sufficient to try and reduce the carbon footprint: more drastic measures need to be put in place and need to be put in place immediately. We strongly believe that only collective action can be successful. This is true in every domain, particularly in the payment industry.

The payment industry contributes to environmental change in many ways

Given its large and varied number of participants, the payment industry has a wide spectrum of environmental impacts. We could name:

- The environmental cost of manufacturing hardware devices compared to their relatively short lifetime ( 5-7 years for a payment terminal and 2 years for a phone)

- The printing of receipts that directly land in the trash bin, if not on the pavement

- The energy used by data centers

In 2017, The DNB (Dutch National Bank) attempted to break down various components of card payment to show their impact relative to the complete card transaction. It demonstrated that:

- Data centres only represent a very small share (10%) of the overall impact of card payments

- The manufacturing of cards also has a rather small impact (around 15%), mainly due to the PVC used to produce them

- Much of the impact (75%) is due to the POS terminal devices, mainly from their materials (37%) and energy consumption (27%)

The study also tells us that more than a third of the overall environmental impact of the debit card payment system (36%) consists of greenhouse gas emissions, mostly through energy usage and transport.

Internally, we are also performing a life cycle analysis of card payment transaction in-store versus e-commerce. Which results are still under scrutiny. Preliminary results show that the highest impacts are driven by tickets, card and POS terminal devices (by decreasing order).

Many solutions do exist!

Once all impact areas are identified, the key question is: what bold action can be taken to cut them drastically? There is no single answer to this question. Nevertheless, surely the most pragmatic approach is to lower these areas of impact via eco-friendly design:

"Eco-design considers environmental aspects at all stages of the product development process, striving for products which make the lowest possible environmental impact throughout the product life cycle."

(source: European Environment Agency).

When it comes to payments, some initiatives have already been launched.

Many would like to see the paper-based receipts, which are still systematically printed in some countries, stopped (ideally fully rather than sent via email to consumers). Here one remaining obstacle is the lack of a harmonised regulatory framework[1] that could go beyond some actors' current conflicts of interest.

A lot can still also be done around manufacturing electronic acceptance devices (terminals, computers, smartphones, payment cards, etc.) A first action should be to increase their life span, while also introducing a repairability index. An even more efficient standby mode could complement this to reduce the energy consumption of an EFT-POS to a bare minimum when they are not used, which, in fact, is most of the time.

The other actions that should be encouraged concern the recycling of materials. Going through recycling channels will reduce the need for new equipment and will thus reduce digital pollution.

Furthermore, as the European leader in digital payments and payment transactions, Worldline has contributed to work on eco-responsible digital services of the French national organisation for standardisation AFNOR (Association Française de Normalisation). The outcome of this working group was the publication in April 2022 by AFNOR of a reference document that sets out principles relating to the indicators and methods for measuring resource consumption necessary for a digital service to qualify as eco-responsible (AFNOR Spec AFNOR SPEC 2201).

Its objective is to establish a consensus on good practices in the design of digital services and to help reduce the impact of digital services (applications, websites, mobile applications) in terms of energy and use of resources. The document covers the entire life cycle of a digital product or service and aims to build a robust methodological document for international application.

Last but not least, it would make perfect sense to apply the concept of eco-design to payment protocols and standards by:

- Simplifying them and decreasing the amount of data exchanged

- Separating security and functional upgrades

It is not that difficult to identify efficient and effective measures that could reduce environmental impacts throughout the payment lifecycle. Awareness within the payment industry is unquestionably increasingalthough it remains quite far from being a green industry. So how do we make this happen?

We are convinced that the only possible approach is a collective one.

Currently, payment companies do not focus on the complete ecosystem, yet a systemic approach is needed: the lifecycle impact assessment and the "end-to-end payment" design need to consider the full environmental life cycle.

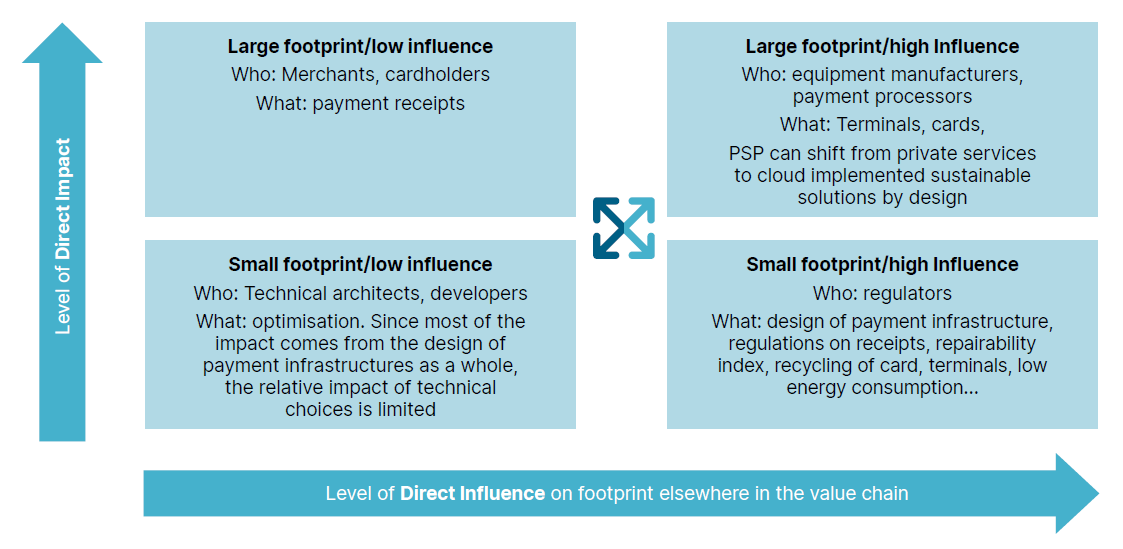

No single company can tackle the problem by itself; collaboration is required between all stakeholders, including those who operate the systems and the public bodies that regulate and supervise them. This means:

- Operational payment stakeholders: consumers, merchants, manufacturers of devices, payment service providers, schemes and standardisation bodies (technology, security)

- Public body stakeholders:

- responsible for the creation of laws and regulations with laws on the environment which may have implications for payments but also regulations more specific to the retail payments (Payment directives)

- those responsible for supervising payment activities at national (AMF) or regional level (EBA)

They all need to collaborate to assess the environmental footprint of the services provided for retail payments and to identify mitigation actions in terms of standards, regulations and deployment or adaptation of technology.

More broadly, we are convinced that companies should align their strategies with the limits of our planet.

Today, companies may feel torn between a traditional view of delivering shareholder value through financial performance or a move to a "post-growth" mindset where financial returns alone might not be the top priority. We want to encourage this shift to a more resource-efficient world, where companies seek to reduce their activities to preserve our planet.

If this challenge is not achieved in the coming years, then the issue won't be about reducing the impacts anymore but about adapting payments to a completely different world, devastated by the climate change and its numerous consequences: floods, droughts, intense rain, heat waves and dire shortages.

The time for action is now, let's ensure we don't miss it!

Contributors

The four authors of this blog post are members of the Worldline Scientific Community, leading the track focusing on Green Payments and Sustainability by Design. They aim at helping Worldline, and the overall payment industry find the right balance between customer and user satisfaction and sustainability:

- Olivier Maas is part of Worldline Labs. He is involved in R&D activities on environmental topics.

- Laurent Rousee is part of Group Operational Performance initiative and in charge of the strategic offshore demand management,

- Nathalie Ska is part of the CSR team and in charge of the corporate documents

- Anne-Claude Tichauer leads the merchant interaction ecosystem strategy within Merchant Services and mostly focuses on data leveraging and UX in order to offer merchants best-in-class services beyond payment.

[1] Please note that in France, a specific law has been enacted in 2020, the anti waste law. Upon adoption of secondary legislation, or at the latest on the 1 January 2023, except if requested by a client, systematic printing and distribution are prohibited of: (i) receipts in brick and mortar stores; (ii) credit card receipts; (iii) tickets from automated machines; and (iv) vouchers and tickets intended for brick-and-mortar store products promotion or offering price reductions for these products.