Digital technology is – as philosopher Bernard Stiegler calls it - a Pharmakon – both a cure and a poison. According to a recent study, the digital world represents a 7th continent in terms of energy and water consumption – between 3 and 5 times the size of France.

Environmental footprint of the digital world as a percentage of total human impact

The limitations of today’s approaches

Service providers across the payment value chain are all working to reduce their environmental impact. However, as in most industries, this action generally happens at the individual corporate level using a “measure, reduce, offset” approach.

The recent “Net Zero Initiative: A framework for collective carbon neutrality” launched by Carbone 4 (a leading consulting firm in low carbon strategy) states that the scope of the greenhouse gas emissions taken into account often overlooks the induced sources of emissions (upstream and downstream in the so-called “scope 3”). The initiative calls for global neutrality.

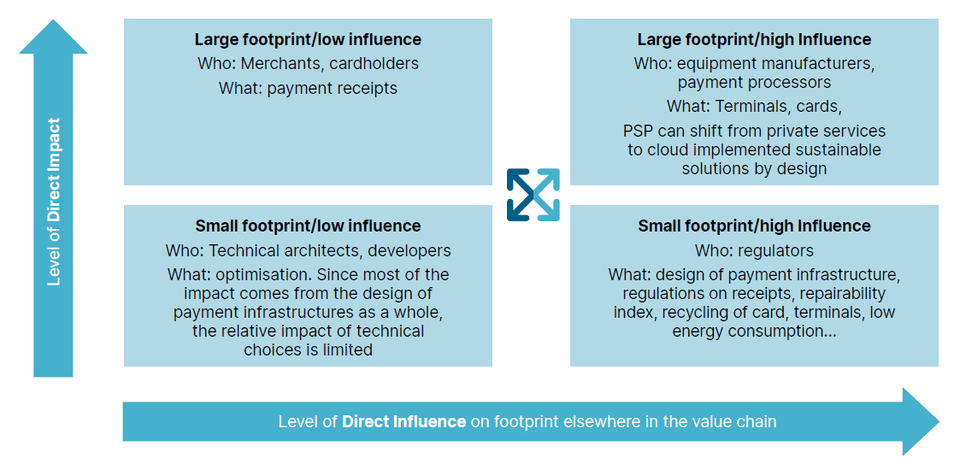

Environmental topics are systemic and complex, and the environmental impacts of payments cannot be identified precisely and reduced unless we consider the problem as a whole. Many approaches are possible at the level of an individual company to minimise the impact of payments. However, they often do not consider the wider value chain or ecosystem. Individual stakeholders do not have a way of measuring the impact of an end-to-end use case. Their efforts may, therefore, only represent a small part of the total footprint. Apart from using an environmental Life Cycle Assessment (LCA), there is no concrete way of knowing and measuring this footprint and acting on it accordingly.

Collaboration to reduce the footprint of payments

Some companies are collaborating to reduce the footprint of payments. Worldline delivers eco-designed payment terminals. Mastercard has analysed the material make up of plastic cards to help issuers offer more eco-friendly cards to consumers. In 2018, it formed the Greener Payments Partnership with Gemalto, Giesecke & Devrient and Idemia to establish environmental best practices and address first-use PVC plastic in card manufacturing.

Nevertheless, most companies do not focus on the complete ecosystem, yet a systemic approach is needed: the lifecycle impact assessment and the design of the “end to end payment” need to consider the full environmental life cycle.

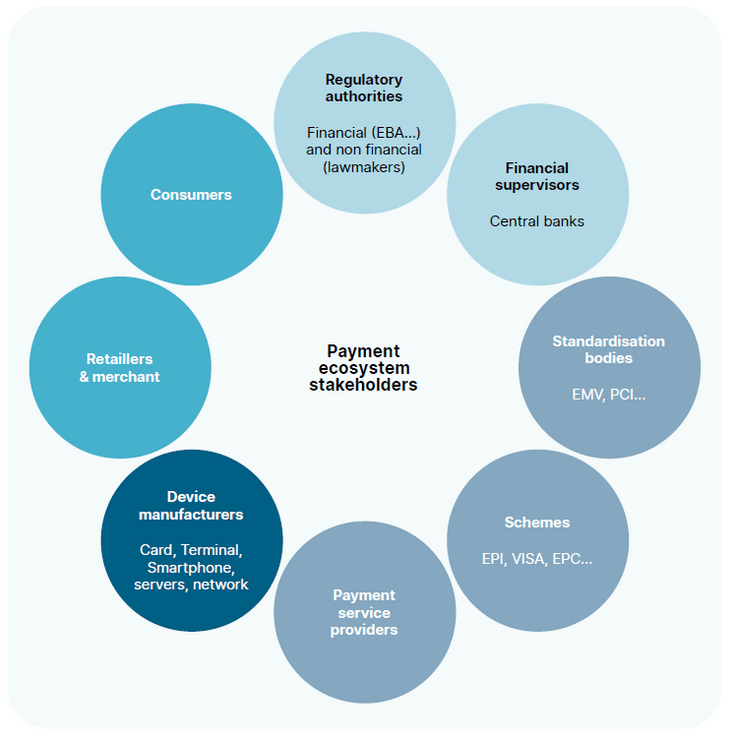

No single company can tackle the problem by itself; collaboration is required between all stakeholders. Including those who operate the systems and public bodies that regulate and supervise them. This means:

Operational payment stakeholders:

- Consumers, merchants, manufacturers of devices, payment service providers, schemes and standardisation bodies (technology, security)

Public body stakeholders:

- Responsible for the creation of laws and regulations with laws on environment which may have implications for payments but also regulations more specific to the retail payments (Payment directives)

- Those responsible for supervising payment activities, at national (AMF) or regional level (EBA)

They all need to collaborate to assess the environmental footprint of the services provided for retail payments and to identify mitigation actions in terms of standards, regulations and deployment or adaptation of technology.